Jaine’s First 0G DEX: My LP Story with OG/stOG

On day one of my $0G airdrop, I felt excited—and curious about what’s next. I noticed only ~20% went to testnet, with ~80% reserved for post-mainnet. Perfect: more to play for, so I decided to dive deeper.

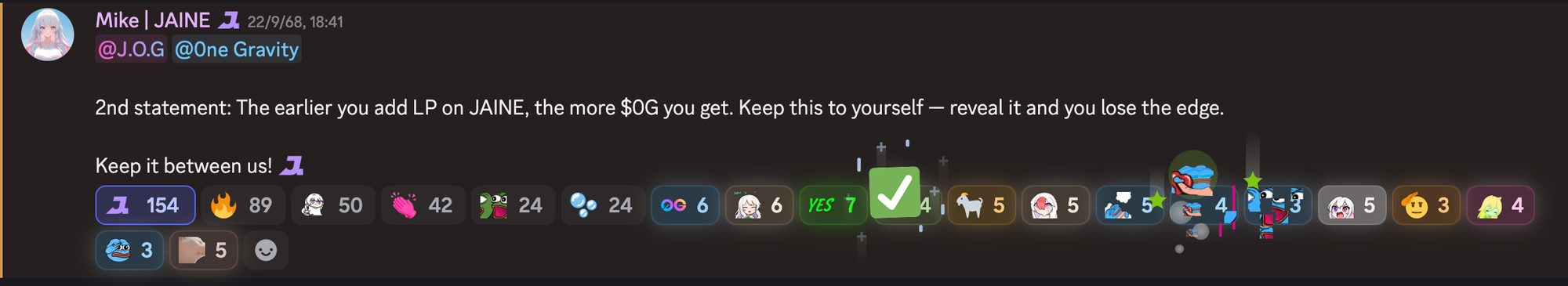

So I decided to stay active in the ecosystem. Jaine became the first project I explored deeper. I also hold OneGravity NFT, so I received a special role and saw the message in Jaine’s Discord that kicked this off.

Then, I went to the Jaine website, opened the Liquidity Pools tab, and found this list:

There were three assets. OG/stOG looked best to me because IL (impermanent loss) should be very low—both sides are linked to the same underlying (like stETH/ETH). There’s still some IL because stOG increases vs OG over time (staking yield), but I double-checked with ChatGPT and it’s tiny compared to the other two pools. (detail later below)

I also expect $0G to appreciate over the next few months, so I didn’t pick OG/USDCe—I didn’t want to convert half my OG into stablecoins and miss upside. OG/PAI is more volatile (meme nature), has fewer transactions, and the price swings are big, so I skipped that too. OG/stOG felt right for my goals.

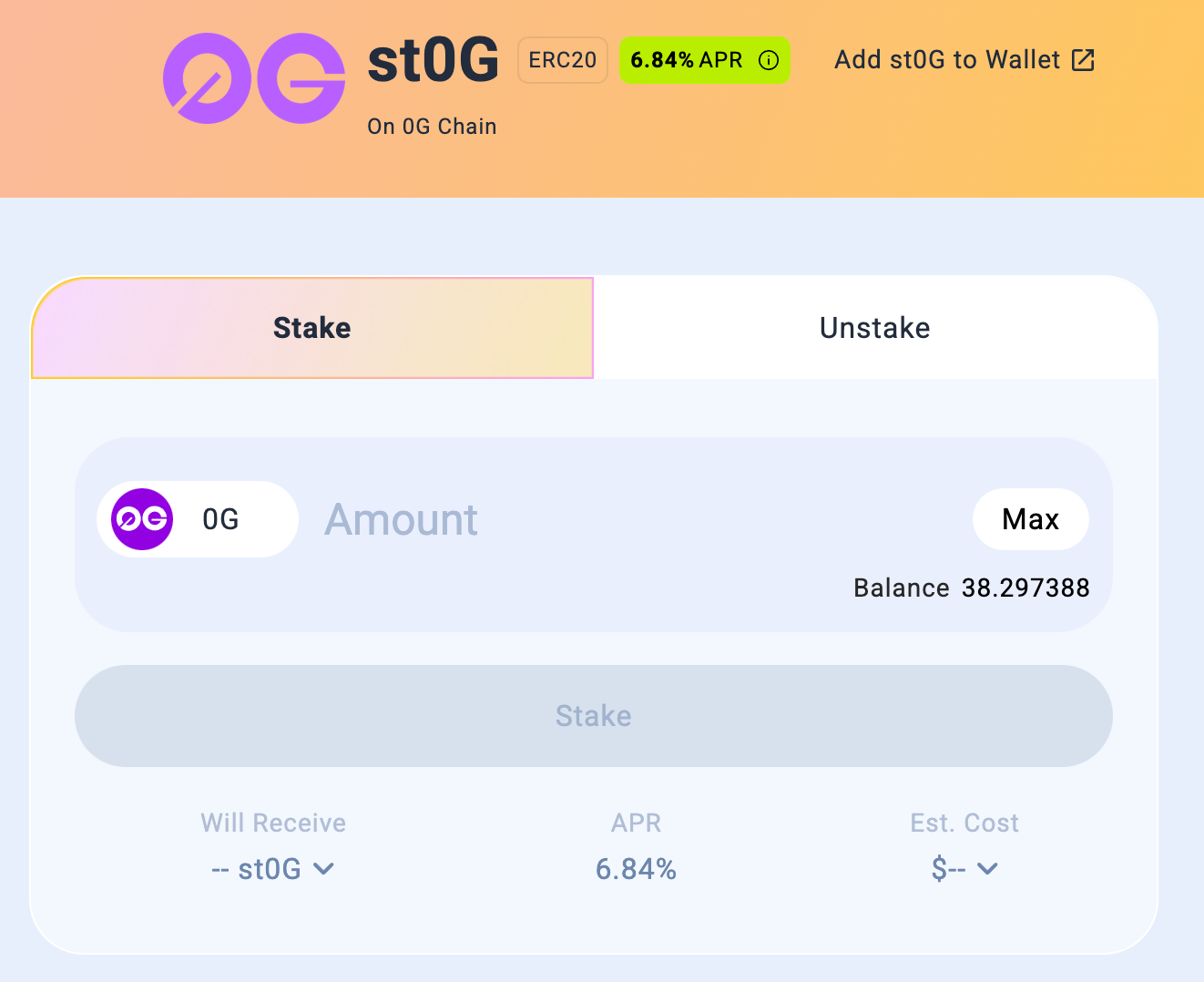

One more thing: when I claimed, I took 50% as OG and staked 50% on Gimo, so I already had OG + stOG on Day 1. If you claimed 100% OG, you can still stake on Gimo to get stOG (no swap fee; and maybe you qualify for a Gimo airdrop—just a guess, not a promise):

https://app.gimofinance.xyz/?tab=stake

Before Start (for beginner)

These are the concepts I wish I had understood before my first LP years ago. Skipping them can cost time—or money.

Impermanent lost

This sounded scary—scarier than it should. I almost gave up when I first learned about it. I was like, ‘What the heck—do I lose my funds permanently? What does impermanent even mean?’

Impermanent loss (IL) is the gap between what your position is worth as a liquidity provider and what it would be worth if you simply held the two tokens. When the price ratio between the tokens changes, the pool rebalances your assets. You can end up with more of the cheaper token and less of the pricier one, which can underperform just holding.

It’s called impermanent because fees and future price moves can reduce or erase that gap; but at any snapshot in time, the shortfall you see is IL.

You don’t need a PhD—just a bit more reading. To make it concrete, I’ll show how small IL is for OG/stOG. Then you’ll see why people still provide LP even though IL always exists. (I used ChatGPT to help calculate it.)

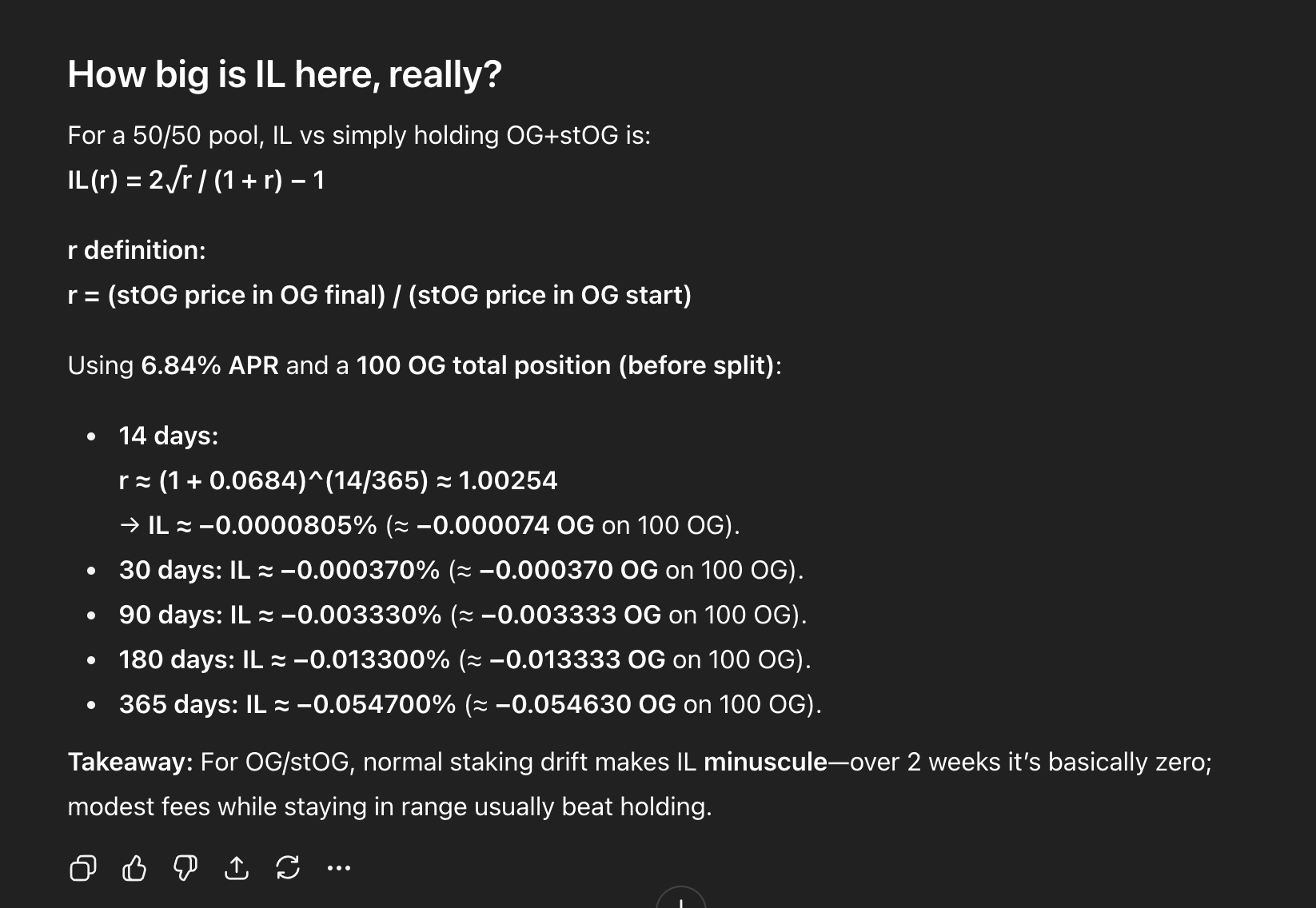

How big is IL for OG/stOG? stOG earns yield (e.g., 6.84% APR), so it slowly appreciates vs OG. Over short periods the IL from this drift is tiny. For a 100 OG total position, it’s basically near zero (0.0000805 $OG) over 2 weeks, and still very small over a year. That’s why people LP this type of pair—the fees usually beat the tiny drift IL as long as you stay in range.

Other Risk

Impermanent loss isn’t the only risk. There’s smart-contract risk—if it’s hacked, you can lose funds. There’s operational risk—if an admin loses keys or acts fraudulently, those keys could be used to pull liquidity and your position would be affected. There’s performance risk—fees may not cover staking rewards when transaction volume is low. These risks exist in any DeFi protocol. I’m highlighting them so you DYOR before providing LP—don’t assume every DeFi platform is safe.

Ready?

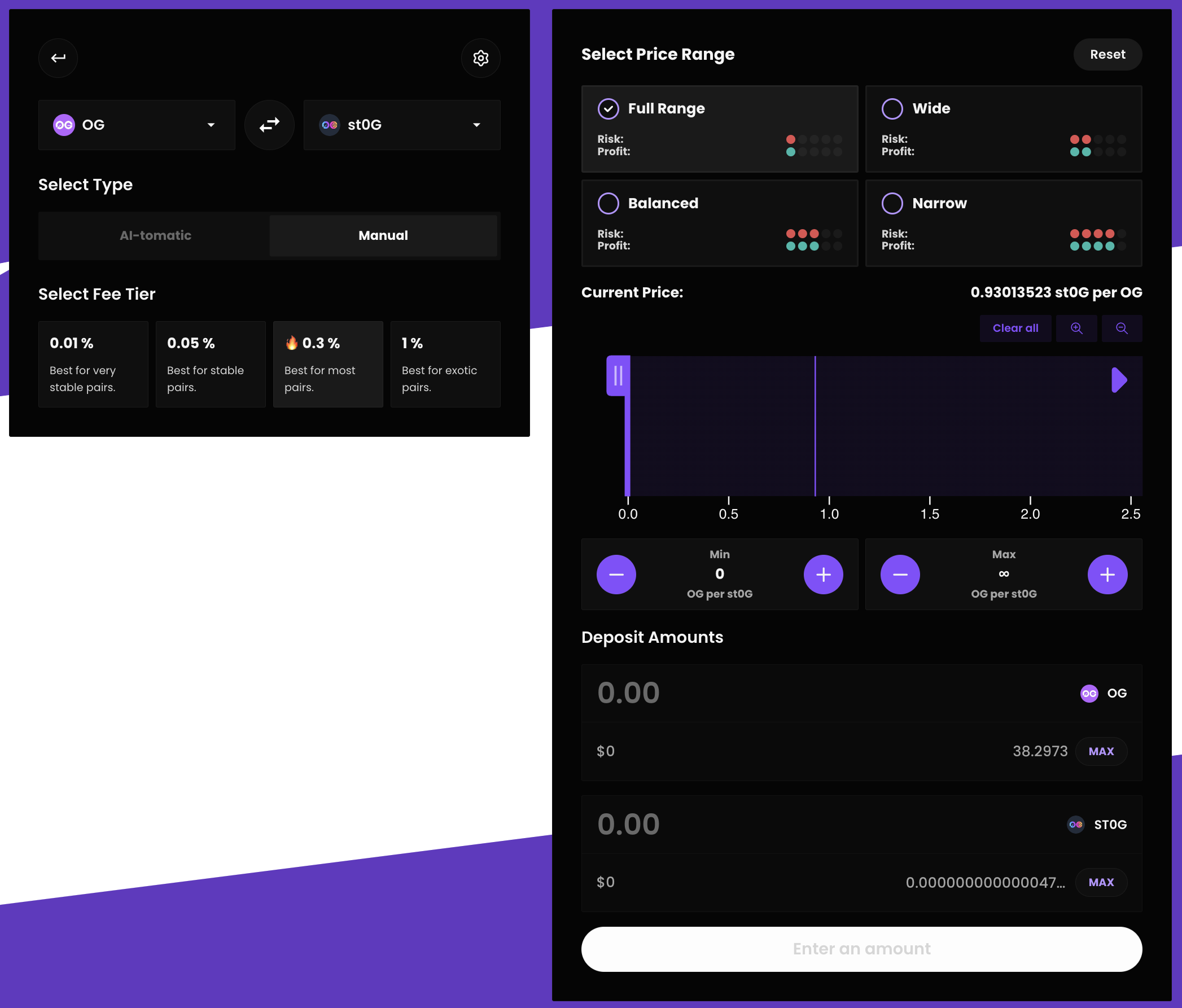

When you have both tokens, you can create a position on Jaine. Click Deposit on the OG/stOG pair and you’ll see something like this:

Fee tier (left side): It usually defaults to 0.3%. Each pool is split into fee tiers. For every swap, the DEX routes to the tier with the best total price (fee + price impact). But, check which tier has depth/volume now, routers follow best total price, not always “default best choice.”

Fee tier typical guidance

- Ultra-stable/pegged: 0.01%–0.05%

- Correlated (OG/stOG): 0.05% (or 0.3% if 0.05% has low flow)

- Normal volatile pairs: 0.3%

- High-vol/illiquid (memes): 1% (or 0.3% if that’s where volume concentrates)

For OG/stOG now: Because the market is just getting started, 0.3% is likely optimal for now. If volume and depth increase on the 0.05% tier, it may become the better choice. We should monitor flows and switch if they shift.

My choice: 0.3% tier.

Next, on the right side, you’ll see price range and deposit amount. Easy part first: deposit amount is how many tokens you’ll provide. At this stage, you need to enter equal value on both sides (OG and stOG). My trick: click Max on one side—if the other side auto-fills and you have enough tokens, proceed; if not, try Max on the other side.

Advance: you can mint single-sided if you set your range edge close to current price.

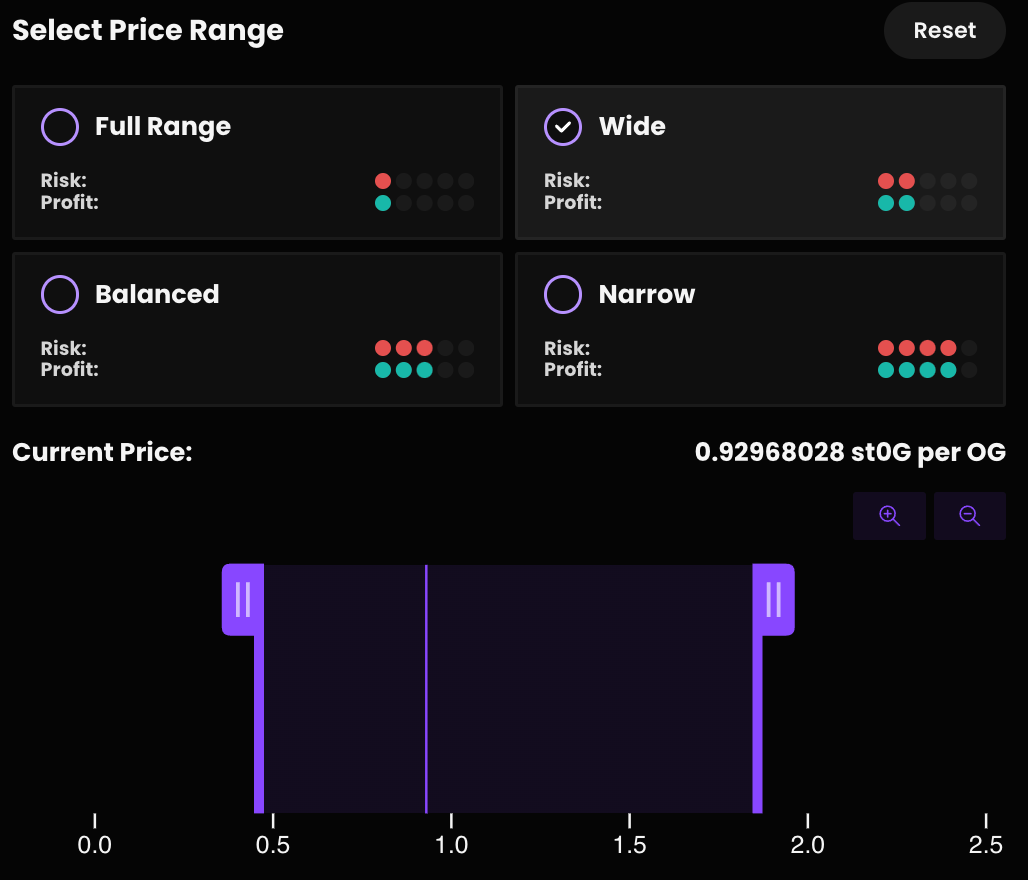

Then comes the price range—this is what you must monitor. If you don’t have time, choose a wider range (you’ll earn less in fees but stay active longer). There are four presets for range

- Full Range: covers all prices (Min = 0, Max = ∞). You’re always in-range, but fees are lowest because your money is spread thin.

- Wide: big range around the current price. Fewer adjustments, moderate fees.

- Balanced: medium range. A compromise between earnings and maintenance.

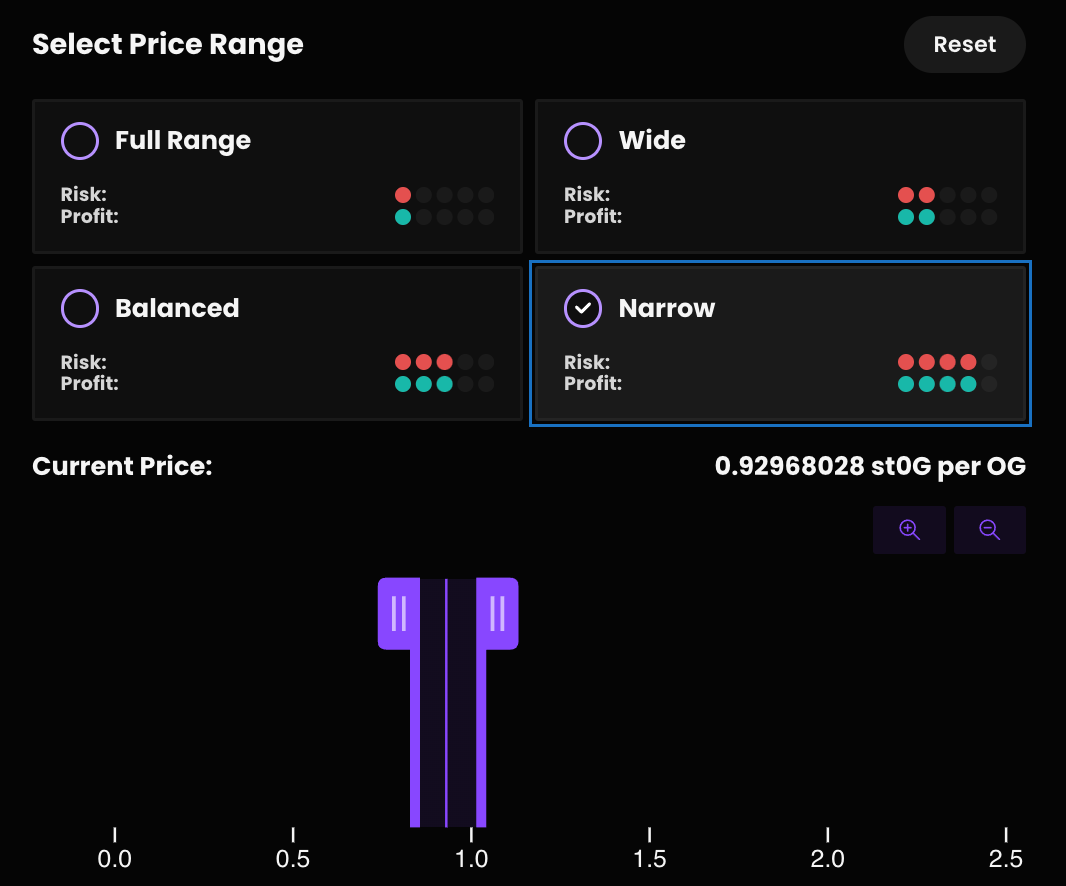

- Narrow: tight range near the current price. Highest fee rate when in-range, but you can fall out-of-range more easily and must rebalance.

Wide vs Narrow Price Range. Narrow gain more fee, higher chance of inactive (not earning).

Think of it this way: if you’re selling in a physical shop, location and number of selling points (kiosks/shops) matter.

- Narrow strategy: place a kiosk at the exact crowd chokepoint—great sales while the crowd is there.

- Wide strategy: run larger shops covering more area—steadier but lower sales per m².

This applies to price range: the more concentrated it is, the more likely your liquidity gets used. For OG/stOG, I aim for a narrow range because the pair is highly correlated and price variance is small—narrow bands give high fee density. I’ll monitor daily (at least weekly). Also, since stOG appreciates over time, a slight right-bias on the range helps

Done?

After you set the price range and the token amounts, you’ll be asked to approve and sign the transaction. Are we done? Yes and no. Your LP becomes active once you sign, but you still need to monitor it.

I once LP’d a meme token. Fees looked great, and I kept compounding them back—classic greed. Then the meme dumped hard. My position went out of range, and when I withdrew I ended up holding only the meme token. I waited, hoping it would come back. A few weeks later it went to zero—the whole position was worthless.

In another case, I paired a meme with SOL using a set-and-forget approach. The meme 10×, pushed price out of range, and I was left with mostly SOL (tiny movement) while missing the moon.

Lesson learned: if I expect a big upside move, sometimes it’s better to just hold. And if I do LP, I need to rebalance on both sharp up and down moves.

Jaine Campaign: Be First - Be Ljquid

Be First - Be Ljquid 🫧

— JAINE ( prev. zer0) (@Jaineon0G) October 3, 2025

JAINE's very first LP campaign on @0G_labs Mainnet is HERE!

We're partnering with @merkl_xyz and going deeper &

juicier with a bag of $OG for all JAINE LPers.

Let's dive in pic.twitter.com/aIM2QFox0a

You should definitely check out this campaign. The earlier you provide liquidity (LP) and the deeper your contribution, the greater your rewards.

According to the post, 70K tokens are allocated to each of the two pools across all epochs of the promotional campaign. That’s a substantial amount. With many OG participants having already exited, those who remain could see significant benefits.

That brings me to the end of today’s story. If you’ve read this far, don’t FOMO and don’t rush. You still have time. Make sure you understand what you’re doing—LP opportunities will still be there tomorrow. Even 1–2 hours of study can prevent significant losses.

Thanks for reading. I’m still exploring the 0G ecosystem; it’s early days. If you have suggestions, ping me on Discord or X, or wherever we connect.